What is the purpose of this legislation?

It has been a decades-long principle of California policy that construction paid for with public funds should be linked to construction trades’ prevailing wages. AB 3190 closes gaps and loopholes in the law, as California budgeting in support of affordable housing has shifted since 2001 from forms of public subsidy that trigger prevailing wage requirements (including multifamily housing program [MHP] loans) to ones that don’t, specifically tax credits and non-MHP, “soft” loans that have below-market interest rates:

- State Low Income Housing Tax Credits [“LIHTCs”] increased to $700 million annually

- Conversion by developers of public grants and fee waivers into low interest, "soft" loans

- Conversion of land donations into long-term land leases capitalized as loans

- Loan programs subject to a statutory exemption in Labor Code section 1720(c)(5)(E) for low interest loans. (see, for example, impenetrable language regarding prevailing wages in AHSC Guidelines at page 55)

State LIHTCs are public subsidies. For every $1 of affordable housing capital raised from tax credit investors, those investors reduce their future state tax liability by $1.20, on average. State General Fund Revenue Losses from State LIHTCs will increase from $250 million in 2023-24 to $390 million in 2025-26 (DOF 2023-24 Tax Expenditure Report).

What interests does the State of California have in requiring payment of prevailing wages to construction workers who build State-subsidized affordable housing?

- Increase the attraction and retention of needed residential construction workers by narrowing the large quality gap between residential and nonresidential jobs.

- Prevailing wage standards include hourly pro rata contributions for health care insurance coverage for the workers and their dependents.

Construction workers in California

- Reduce construction workers’ reliance on federal and state social safety net programs. Nearly half of California construction households have at least one member who depends on one or more major social safety net program (Medi-Cal, CHIP, EITC, CalFresh, TANF) at an inflation-adjusted annual cost of approximately $4 billion (UC Berkeley Labor Center 2021). Safety net dependency is concentrated among residential specialty contractors’ employees, whose pay is 30% less on average than nonresidential specialty contractors’ workers.

- Reduce #s California housing construction workers who qualify for housing subsidies. Over half of California construction worker families qualify by HUD income standards as “low income.” In dense coastal metro areas 40% qualify as “very low income”, which is high compared to the rate for non-construction families (Littlehale 2020, pp. 9-10)

- Reduce endemic wage theft/tax fraud among California’s residential contractors.

- Researchers estimate $1 billion in federal & state tax revenues is annually lost from California construction underground economic activity (Source, see Map 2).

- Construction disproportionately accounts for 33% of State wage judgments (Source).

- Workers employed on State-subsidized housing projects without protections offered by California’s public works laws have shared experiences of gross violations of wage, hour, safety, and health standards with union labor compliance investigators.

- Public works construction projects have a vastly superior compliance & enforcement record – recovering tens of millions of dollars in back wages compared to mere hundreds of thousands of dollars in the private construction enforcement realm.

What could be the scope of the impact of this bill?

- Thousands of construction trades workers employed annually on California-subsidized projects are impacted by the prevailing wage loopholes. Over half of allocated State LIHTCs and 50% of projects that receive below market-rate interest loans are not required to pay State prevailing wages, involving at least 13,000 units of housing.

- Re: motion picture credits: Neither the author nor the sponsors intend for prevailing wages to apply to motion picture sets. Public works laws cover construction, installation, alteration, etc. of structures, building fixtures, or building equipment that form part of real property. (see DIR public works coverage determination cases).

The California Housing Consortium opposes AB 3190. Who receives State LIHTCs and are all developers of affordable housing opposed to extending prevailing wages?

- Almost 90% of State LIHTCs for projects that do not require prevailing wages went to projects developed by for-profit companies.

- California allocated over $260M - 20% of total State LIHTCs allocated between 2020-2023 - to projects developed by one Idaho-based for-profit firm.

- Some affordable housing developers who almost always pay prevailing wages are indifferent; some welcome a more level playing field in the competition for State subsidies; some compete consistently and with success for subsidy funds without prevailing wage requirements and are opposed.

What implications do prevailing wages have for affordable housing production costs?

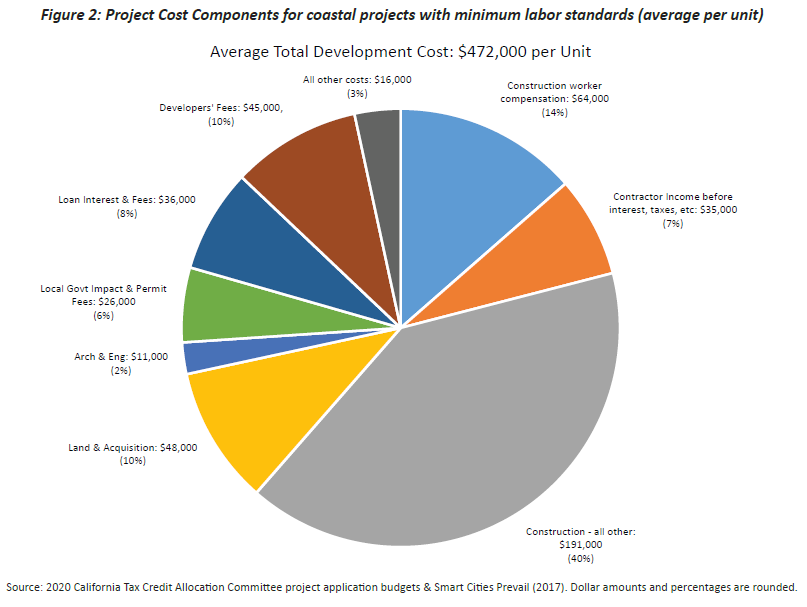

- Construction trades workers’ compensation accounts for under 20% of total project costs for California affordable housing total cost budgets, on average. This share is smaller than the combined share of costs charged for landowners, construction firm owners, real estate development firms, and construction lenders (35%). See pie chart on pg 4.

- Most studies of prevailing wages and nonresidential public works projects do not find statistically significant project cost impacts. The explanation is that higher wages prompt management-side responses that boost efficiency & productivity. Residential construction is an infamous case of an industry exhibiting negative productivity changes in an economy of productivity growth. Low wages perpetuate low productivity.

- Belman and Hinkel (2022), in a peer-reviewed, journal-published study, found up to a 6% average total project cost increase associated with prevailing wage requirements. Their study is based on data from a State of California study of final, certified project costs.

- Opponents cite a Terner Center study that was not published in a peer-reviewed journal. In contrast to Belman and Hinkel, Terner analyzed pre-construction budget data from LIHTC-funded projects. Budgeted cost figures are subject to change prior to project completion. Terner’s analytical model did not include control variables that Belman and Hinkel found to be statistically significant, which could have biased Terner’s estimates of cost effects. The paper’s authors did not share their data when requested in 2020.

- Belman and Hinkel contextualized any estimate of cost impacts of prevailing wages: “The implicit baseline for this research has been the current practices in the residential construction industry, including the cost advantages realized by contractors engaging in illegal and undesirable practices. An alternative baseline would be the cost of building affordable housing for contractors who abide by labor standards, classify their workers correctly, and pay the required amounts in social insurance and taxes.” (emphasis added)

What is pro- vs. anti-affordable housing policy?

Increasing the supply and affordability of housing in California priority objectives of the author and the sponsors of AB 3190.

Housing affordability is a two-sided coin: housing costs on one side; Californians’ incomes, from which housing costs and other basic essentials can be paid, on the other side.

California construction workers, seventy percent of whom are non-white and/or Hispanic, are more likely to be low-income, housing cost-burdened, qualify for subsidized housing, live in overcrowded housing, and to either be uninsured or depend on Medi-Cal.

Construction workers’ ability to meeting basic needs is in great part a function of improved pay and fringe benefits, since most will not win the affordable housing lottery and a significant percentage must pay medical expenses out of pocket (or forgo care), due to being uninsured.

The author and the sponsors are steadfast champions for pro-affordable housing government interventions that boost affordable housing production and uplift workers and their labor standards rather than perpetuate low pay and illegal practices.